Price stability in the economy is the anchor on which the entire enterprise of the country rests. Having trust in the purchasing power of currency notes encourages companies and policymakers to pursue policies with a long term horizon. It also provides comfort to households by encouraging them to save and invest in longer term assets. As is oft repeated, the future is uncertain’, and having stable prices provides a layer of certainty over this volatile future.

Inflation, a corollary that is widely used to describe price stability in the economy, is a measure of the erosion of the purchasing power of currency notes. Having persistently high inflation breaks the stability of a country’s monetary system. During the 2008 hyperinflation period in Zimbabwe, people switched to the US dollar as legal tender instead of the Zimbabwe dollar. When the monetary system collapses, chaos and uncertainty become the order of the day, as was seen during the collapse of the Sri Lankan economy in 2021.

But monetary stability alone is not a panacea for a peaceful society. It must be accompanied by growth. As we grow, both in quantity and quality, our demand from the economy keeps increasing. We want bigger houses, nicer clothes, better cars, and so on. Balancing growth without compromising on monetary stability is the biggest puzzle for central bankers all around the globe. Among the many factors responsible for economic growth, credit supply does have a disproportionate share, assuming the fundamentals of the economy remain robust. Things bought on credit (or loan) have a cascading effect on the economy. And the reverse is true as well. If credit becomes dearer, so does the demand. People tend to preserve money rather than to spend it.

And thus comes the dilemma of the RBI: balancing growth without compromising the monetary stability of the country. The inflation targeting framework (ITF) was first used by New Zealand in 1990, and since then it has been used by many countries globally. Under this framework, central banks around the globe tweak the short-term interest rate as a means to stimulate demand in the economy. A slight increase in the benchmark rate increases the cost of capital, which suppresses demand in price-sensitive sectors. This implies increasing the rate when inflation is high and vice versa. However, a higher interest rate in the economy also kills investments as many projects become unviable,and suppressed demands don’t provide the incentives for the company to produce and hire more.

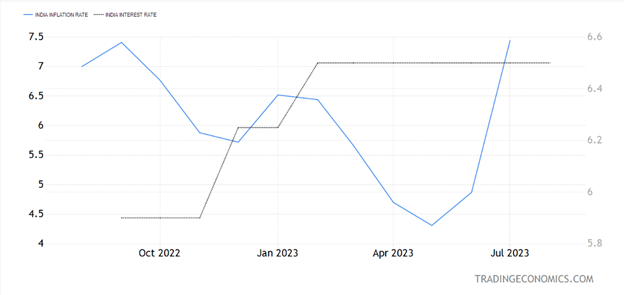

In the chart below, CPI Inflation and Repo rate have been plotted for the last 1 year.

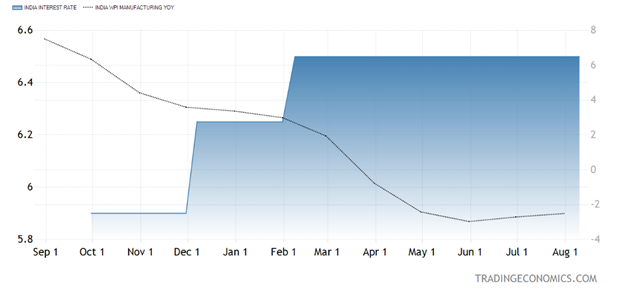

Any effect of repo rate changes will be visible on the economy in the next quarter as their is a lag in the transmission of interest rates in the country. Food and beverages make up the majority of the consumer price index (45.86 percent of the total weight), with cereals and products coming in second with 9.67 percent. From the above graph, it becomes clear that there is a minimal effect of interest rate changes on the CPI, primarily because food and beverages have a higher weight in the CPI. Food prices are immune to interest rate changes as both demand and supply are inelastic in nature. In 2013, the RBI replaced WPI with CPI as the main measure of inflation in the economy. However, around 70% of the weightage in the CPI is given to agricultural produce and commodities, which have a very low correlation with the repo rate. The Wholesale Price Index measures the price of a representative basket of wholesale goods and is divided into three groups. Primary Articles (22.6 percent of total weight); Fuel and Power (13.2 percent); and Manufactured Products (64.2 percent). The Food Index from the Primary Articles and Manufactured Products groups accounts for 24.4 percent of the total weight. If we compare the impact of the RBI’s repo rate on WPI Manufacturing, we see a visible impact of demand receding due to higher costs. The table below shows the correlation of WPI Manufacturing with Repo rates for the last 1 year.

In a nutshell, we can summarize that the repo rate as a policy tool to curb inflation has a minimal impact on food inflation but a visible impact on manufacturing. And hence, the blind pursuit of curbing inflation through interest rate changes needs to be revisited.

The RBI has been doing phenomenal work in providing pricing stability to the economy, but it needs to devise newer policy tools to check food inflation. Aggressive rate hikes to curb food inflation could inadvertently slow down the overall economy by raising borrowing costs for businesses and consumers. This could have unintended consequences for employment, investment, and other sectors, which might not be the desired outcome.

Given these limitations, the RBI and policymakers might need to consider a combination of measures beyond changes in the repo rate to effectively address food inflation. These could include targeted policies to enhance agricultural productivity, improve supply chain infrastructure, manage trade policies, and implement social safety nets to protect vulnerable populations from the impacts of rising food prices.

Let’s delve into each of these potential measures to address food inflation in more detail:

- Enhancing Agricultural Productivity:

Improving agricultural productivity involves implementing policies and practices that enhance crop yields and production efficiency. This can be achieved through investments in research and development of new crop varieties, better farming techniques, and access to modern farming equipment. Training and education for farmers can also contribute to improved agricultural practices and higher yields.

- Improving Supply Chain Infrastructure:

A well-functioning supply chain is crucial to ensuring that food products reach consumers efficiently and at reasonable prices. Investments in transportation, storage facilities, and cold chains can help prevent waste and reduce delays in getting food from farms to markets. Addressing bottlenecks in the supply chain can lead to more stable food prices.

- Managing Trade Policies:

Trade policies can impact food prices by affecting the flow of goods across borders. Sensible trade policies can ensure a steady supply of essential food items by allowing imports when domestic production is insufficient. However, trade policies should be carefully managed to avoid dependency on imports and protect domestic producers from unfair competition.

- Implementing Social Safety Nets:

Social safety nets are programs designed to provide financial assistance and support to vulnerable populations during times of economic hardship. These programs can include targeted subsidies for essential food items, cash transfers, or food distribution programs. Such measures can help mitigate the impact of rising food prices on low-income households.

- Investing in Research and Development:

Research and development efforts can lead to innovations in agriculture, such as drought-resistant crops, disease-resistant varieties, and efficient farming techniques. These innovations can help increase agricultural productivity and reduce the susceptibility of food production to external shocks.

- Promoting Sustainable Agriculture:

Emphasizing sustainable agricultural practices can lead to more stable food production over the long term. Practices such as crop rotation, organic farming, and integrated pest management can improve soil health, reduce the need for chemical inputs, and enhance the resilience of crops to adverse conditions.

- Encouraging Price Stabilization Mechanisms:

Governments can establish mechanisms to stabilize food prices by creating buffer stocks of essential commodities. These stocks can be released into the market during times of shortage to prevent excessive price spikes. Price ceilings and floors can also be set to prevent extreme price fluctuations.

- Supporting Smallholder Farmers:

Many food producers are smallholder farmers who may lack access to modern farming technologies and markets. Providing them with training, access to credit, and market linkages can help increase their productivity and income, contributing to a more stable food supply.

- Climate Resilience Strategies:

Climate change can disrupt agricultural productivity, leading to supply shocks and price spikes. Developing strategies to adapt to and mitigate the impacts of climate change, such as drought-resistant crops and water management systems, is crucial for ensuring stable food production.

In essence, addressing food inflation requires a multi-faceted approach that goes beyond monetary policy tools like the repo rate. By combining targeted policies to enhance agricultural productivity, improve supply chain infrastructure, manage trade, and implement social safety nets, governments and policymakers can create a more resilient and stable food system that benefits both producers and consumers, while mitigating the negative impacts of blindly pursuing targeted inflation through policy rates.

About the author:

Satya, is an IIT/IIM graduate who currently works with a major bank in the country. He is a voracious reader with interest in finance, technology and history. When not working, he likes to travel and see new places

(Views expressed are personal)